Staff

FAQs

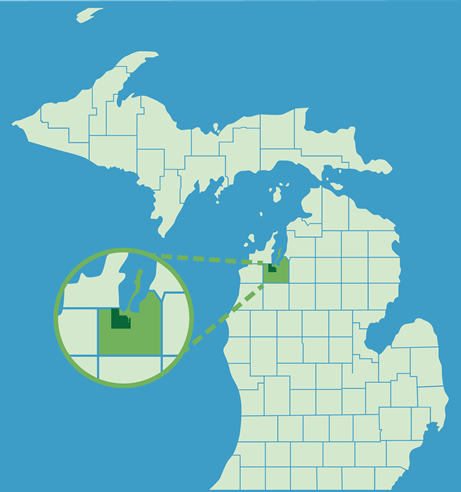

About the Assessing Department

The Garfield Township Assessing Department is entrusted with the responsibility for the inventory of all property within the Township and the valuation of all taxable property, both real property (land and buildings) and personal property (tangible). The Department operates under the requirements of the General Property Tax Law, which was originally P.A. 206 of 1893. The statutes can be found under MCL 211.1 through MCL 211.157.

Assessments are determined annually by calculating the True Cash Value of each taxable property, which is then assessed at 50% of True Cash Value. (Per MCL 211.27 "true cash value" means the usual selling price at the place where the property to which the term is applied is at the time of assessment, being the price that could be obtained for the property at private sale, and not at auction sale except as otherwise provided in this section,,…)

It is the responsibility of the Assessing Department to maintain the integrity and accuracy of the assessment and tax rolls. That responsibility includes some of the following:

- Processing Principal Residence Exemptions (Homesteads), Principal Residence Exemption Rescissions, Conditional Rescission of Principal Residence Exemption request

- Reviewing all deeds and updating the tax roll to reflect current property ownership

- Maintaining a record of sales activity to determine fair market value and assessed value

- Continually updating property information with new construction and demolitions

- Processing land division or any legal description changes to the assessment or tax rolls

- Assisting taxpayers with information, including appeal information

- Maintaining a record of all business personal property, along with the valuation and exemptions

- Annually calculating the capped and taxable value for all property

Resources

Personal Property Exemption

Taxpayers are no longer required to annually file Form 5076 in order to claim the exemption. However, all taxpayers MUST file ONCE to claim the exemption. Once granted, the exemption will continue until the taxpayer no longer qualifies. To be eligible, the taxpayer must meet certain criteria noted in the Letter to Business Owners. Deadline filing date is February 20th, each year - see Letter to Business Owners for filing instructions.

Principal Residence Exemption

Treasury: Principal Residence Exemption Doesn't Expire - The Michigan Department of Treasury is reminding Michiganders that a Principal Residence Exemption – known as a PRE – does not expire.

“Simply put, there isn’t an expiration date on a Principal Residence Exemption,” said acting Deputy State Treasurer Anne Wohlfert, who oversees Treasury’s State and Local Finance programs. “Homeowners who have claimed a Principal Residence Exemption do not have to refile the required form unless they move.”

A PRE exempts a residence from the tax levied by a local school district for school operating purposes up to 18 mills. To qualify for a PRE, a person must be a Michigan resident who owns or occupies the property as a principal residence.

For more information about property taxes, go to www.michigan.gov/propertytax or follow the state Treasury Department on Twitter at @MITreasury.

Reports

Annual Assessment Roll Report

The purpose of the Annual Assessment Roll Report is to provide:

A synopsis of the Township’s Fiscal Year property tax base;

An overview of the Township’s various property tax incentive programs and exemptions;

The results of the most recent Assessment Administration Audit of Minimum Assessing Requirements, performed by the State Tax Commission;

Legislative changes affecting assessment administration; and

Trends and forecasts in the real estate market.

Land Value & Sales Studies

-

- Residential

- Maps

- ECF (Neighborhood) Studies

- 2023

- 2024

- 2025

- Land Value Studies

- 2023

- 2024

- 2025

- Sales Studies

- 2025

- 2023

- 2024

- Commercial/Industrial

- Maps

- ECF Studies

- 2023

- 2024

- 2025

- Land Value Studies

- 2023

- 2024

- 2025

- Sales Studies

- 2025

- 2023

- 2024

Veterans Exemption

Assessing Forms

-

- Assessing Forms

- Land Division Forms

- PRE Forms

Land Division

If you do not have legal-sized paper available, the Assessing Department can provide these forms.